salt tax deduction new york

The climate change deal brewing in Congress which would fund the massive investment in clean energy with new taxes on corporations came with some. That was the unequivocal statement in January from Reps.

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

The federal tax reform law passed on Dec.

. In 2018 Maryland was the top state at 25 percent of AGI. The SALT cap limits a persons deduction to 10000 for tax years beginning after December 31 2017 and before January 1 2026. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

In tax years 2018 to 2025. The SALT deduction cap would stay at 10000. 10000 federal cap on the state and local tax SALT deduction a study.

WASHINGTON A plan by House Democrats to reduce taxes for high earners in states like New Jersey New York and California in their 185 trillion social policy spending package. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household. The decline from 2016 to 2018 was driven by the SALT deduction cap and to a lesser extent the drop in itemization due to the doubling of the standard deduction.

The SALT cap is the limit on a persons. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

It once provided significant tax relief in states like New York and California where the local tax burden is heavy. Rather than repealing SALT especially now when the need to spend on public health and education is clearer than ever the limit on. The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021.

For example the average SALT deduction claimed in New York was 23804 in 2017 and 5451 in Alaska in the same year according to Internal Revenue Service data. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. The unlimited SALT deduction allowed millions of Americans to use state and local tax bills to reduce federal taxes on a dollar-for-dollar basis.

Beginning in 2017 SALT deductions. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for many middle-class residents of high-taxed states like New York where property taxes on a downstate suburban house can approach or exceed the limit. No SALT no deal.

New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. This election can alleviate the loss of the SALT deduction suffered by many New York taxpayers as a result of the federal SALT cap whether they are New York residents or non-residents. A larger group with 32.

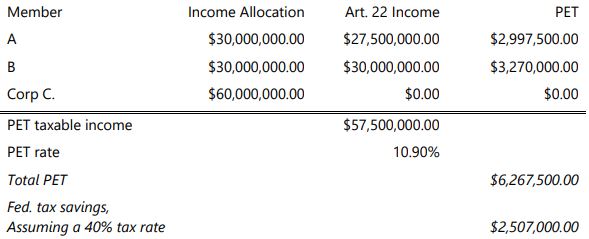

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. This provision is not available for publicly traded partnerships. The Pass-Through Entity tax allows an eligible entity to pay New York State tax.

The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law. Scott is a New York attorney with extensive. Supreme Court on Monday rejected a bid by New York and three other states to overturn a 10000 cap on federal tax deductions for state and local taxes that Congress.

The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Tom Suozzi of New York.

April 18 2022. Many states have recently enacted SALT cap workarounds to protect. Josh Gottheimer and Mikie Sherrill of New Jersey along with Rep.

Why 5 Million Is Barely Enough To Retire Early With A Family

Easter Seals A Pair To Remember Millenia Mall Model Trevor Anderson Better Every Day 2013 Ambassador Meghan Hayes And Mar Easter Seals Easter Service Trevor

Salt Tax Repealed By House Democrats The Washington Post

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Final Gop Trump Bill Still Forces California And New York To Shoulder A Larger Share Of Federal Taxes Under Final Gop Trump Tax Bill Texas Florida And Other States Will Pay Less Itep

It S Personal Planning For New York S Pass Through Entity Tax Lexology

Art Print New England Travel Ads Poster By Lantern Press 24x18in England Map Map Art Print New England

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Blue Streak Daily On Twitter Sofa Online Wayfair Online Furniture

Trump Wants To Kill One Of The Most Popular Tax Deductions

Lovebirds By Ballookey 2008 Adver Sponsored Aff Ballookey Lovebirds Lovebirds Art Wall Art Prints Framed Wall Art