how are property taxes calculated in pasco county florida

The median property tax on a 18570000 house is 168987 in Pinellas County. 3 Unimproved Residential Parcels.

The median property tax in Pasco County Florida is 1363 per year for a home worth the median value of 157400.

. The Office of Tax Collector was established in the 1885 Florida Constitution with the idea that a locally elected official would be more responsive to the needs of the community they serve. General Information Common Questions. The Tax Amount is calculated by multiplying the Taxable Value by the Millage Rate and dividing by 1000.

Responsible for water resources in and beyond Pasco County. The median property tax on a 15740000 house is 165270 in the United States. SW FL Water Mgt District.

TAX COLLECTOR PASCO COUNTY FLORIDA Thank you for allowing us to serve you. This calculator can only provide you with a rough estimate of your tax liabilities based on the. The Pasco County assessors office can help you with many of your property tax related issues including.

Unpaid Tangible Taxes become delinquent on April 1st of the year following the year of assessment. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. As calculated a composite tax rate times the market value total will show the countys whole tax burden and include your share.

All fees are subject to legislative changes. A late penalty of 15 of the tax amount is added on April 1st. The median property tax on a 18570000 house is 194985 in the United States.

The median property tax on a 15740000 house is 152678 in Florida. To calculate your taxes we first need to locate your property. The median property tax on a 18570000 house is 180129 in Florida.

To find detailed property tax statistics for any county in Florida click the countys name in the data table above. 65 of the maximum number of single family residential units allowed under applicable. Not for Mailing Purposes.

For a nationwide comparison of each states highest and lowest taxed counties see median property tax by state. If you think you may qualify and wish to apply please call our office at 727-834-3447. Each parcel within agricultural residential or mobile homes zoning districts are assessed the greater of the ERUS under a 3 below or the actual number of existing dwelling units in place at the time of the assessment.

Florida is ranked 955th of the 3143 counties in the United States in order of the median amount of property taxes collected. Pay Your Taxes Online creditdebit card fees are authorized by Florida Statute 215322 and are paid to the credit card vendor. Were proud to serve the communities we call home while delivering the annual assessment roll for one of Floridas fastest growing counties.

Base tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not. The Pasco County Sales Tax is collected by the merchant on all qualifying sales made within Pasco County. Pasco County Clerk Comptroller Office Hours.

14236 6th Street Room 100. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

As well as paying taxes on real estate you can transfer taxes on Tangible Personal Property through wire transfers. Pasco County property owners. If we can assist you in any way please dont hesitate to.

The median property tax on a 23510000 house is 246855 in the United States. Cost of Home price of homeproperty No. This is largely a budgetary exercise with entity managers first budgeting for yearly spending targets.

Please be sure to use the correct calculator for your document type. Thank you for visiting your Pasco County Property Appraiser online. The above property tax bill is meant to serve as a general example showing the different agencies that levy taxes for.

Please note that we can only estimate your property tax based on median property taxes in your area. These are deducted from the assessed value to give the propertys taxable value. The median property tax on a 23510000 house is 209239 in Sarasota County.

All information regarding your household income must be collected including Social Security employment child support bank accounts pensions and other income and assets. The Pasco County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pasco County local sales taxesThe local sales tax consists of a 100 county sales tax. Please visit our records search page locate your property then click on the Estimate Taxes link at the top.

Current taxes are payable through VISA MasterCard Discover American Express and E-Check and payment can also be made online. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. East Pasco Government Center.

Groceries are exempt from the Pasco County and Florida state sales taxes. Florida Property Tax Rates. My team and I are committed to exceptional service fairness and accuracy.

No part of the fee is retained by the Pasco Tax Collectors Office. Then they calculate the tax rates needed to cover those budgeted expenses. 352-521-4433 727-847-8151 813-929-2780.

The median property tax on a 15740000 house is 136938 in Pasco County. For more information about mobile home taxes contact Pasco County Property Appraiser. The median property tax also known as real estate tax in Pasco County is 136300 per year based on a median home value of 15740000 and a median effective property tax rate of 087 of property value.

Pasco County provides taxpayers with a variety of tax exemptions that may lower propertys tax bill. The Pasco County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Pasco County and may establish the amount of tax due on that property based on the fair market value appraisal. Pasco County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax.

The Tax Collector is an independent constitutional officer elected by the voters of Pasco County for a four-year term. The median property tax on a 23510000 house is 228047 in Florida. Dade City FL 33523.

Pasco County collects on average 087 of a propertys assessed fair market value as property tax.

What Is Florida County Real Estate Tax Property Tax

Florida Sales Tax Information Sales Tax Rates And Deadlines

Florida Real Estate Taxes What You Need To Know

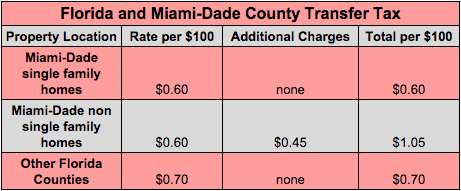

Transfer Tax And Documentary Stamp Tax Florida

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Florida Property Tax H R Block

Florida Dept Of Revenue Property Tax Data Portal

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Florida Real Estate Taxes What You Need To Know

Your Guide To Prorated Taxes In A Real Estate Transaction

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What Is Florida County Tangible Personal Property Tax

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates